Affordability | The One Issue That Will Derail Home Price Growth

Learn how affordability issues are forcing homebuyers to exit the real estate market in Massachusetts.

Homeowners NOT Selling

Why are so many likely home sellers (retirees, empty nesters, etc.) sitting out what many are calling the best real estate market ever?

According to Alice, a Natick homeowner for the last 20+ years, “I want to sell my home but it’s just too expensive and difficult to find a new home in this market. I don’t want to rent, and I don’t want to be homeless. Besides any profit I make on the sale of my existing home will be used to pay for my new home. There are no deals out there and everything is relative.”

Alice’s response is not only understandable but fairly typical these days. Homebuyers including those selling their home are frustrated and concerned by the lack of homes available for sale. This is why many “would be” home sellers have decided to sit out this “once in a lifetime” market opportunity to sell.

Homebuyers NOT Buying

As previously mentioned, the lack of housing inventory is forcing many “would be” home sellers to sit out this rare market opportunity. Indeed, making the current housing supply-demand imbalance even worse.

The good news, however, is that the current supply-demand imbalance is shrinking albeit ever so slightly. The bad news is the reason why – “shrinking demand”. Homebuyers, due to the compound effects of rising home values and higher interest rates, are beginning to be priced out of the market.

“Homebuyers are gradually being priced out of the market which oddly is correcting the present supply-demand imbalance in single-family homes”

As respects Team Coyle’s outlook for home price growth in the second half of 2022, we renew our guidance (First Inflation, Now Higher Interest Rates) that home price growth will continue to increase but at a decreasing rate as the pool of eligible homebuyers gradually declines due to affordability issues.

Our guidance takes into consideration the Federal Reserve’s (The FED) decision to raise its key policy rate (see next section below) and our expectation that the inflation rate will reach double digits before year-end.

The FED Strikes Again

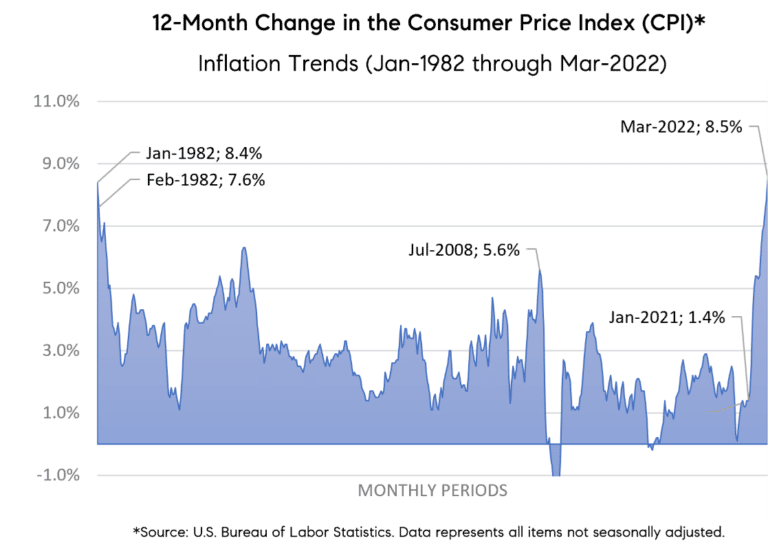

On April 21, 2022, Jerome Powell, the Chairman of the FED finally acknowledged that inflation (see chart to right) is running much hotter than he previously anticipated and that more aggressive action on the FED’s part is needed.

Unfortunately for homebuyers that means higher borrowing costs as the FED intends to raise its key policy rate from 25 basis points (previous guidance) to 50 basis points. It also means that homebuyers with marginal financial capacity will face affordability issues as the combination of rising home prices and higher borrowing costs will likely hinder their ability to qualify for a mortgage loan.

Advice for Homebuyers

The first step is to hire a real estate agent who a) knows the market, b) can help you find a house suitable to your needs and budget and c) knows how to get your offer accepted.

Secondly, if you require a mortgage loan to facilitate your purchase, then you need to consult with a qualified loan officer to get that pre-approval in advance of your search. Invite your real estate agent to get involved in those conversations. Together, they should be able to help you make an informed decision on how much house you can afford, and which communities match your budget and needs. As part of those conversations, make sure to discuss the feasibility of waiving the mortgage contingency on any offer you make. Ultimately, you may decide against waiving the mortgage contingency, but you should at least have that conversation as many accepted offers are taking that step.

Lastly, don’t get discouraged and above all be patient. The current market conditions certainly favor the seller but that won’t last forever. Eventually, demand and supply for housing will balance out and you will find a house within your budget and that meets your needs. Like the old proverb says – “good things come to those who wait”.

Disclaimer: The views and opinions expressed in this commentary reflect Team Coyle’s beliefs and observations as of the date of publication. Team Coyle undertakes no responsibility to advise you of any changes in the views expressed herein. No representations are made as to the accuracy of such observations and assumptions and there can be no assurances that actual events will not differ materially from those assumed. The forward-looking statements in this paper are based on Team Coyle’s current expectations, estimates, forecasts and projections, and are not guarantees of future performance. Actual results may differ materially from those expressed in these forward-looking statements, and you should not place undue reliance on any such statements. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as investment advice.

Team Coyle

Team Coyle is a top-ranked, professional real estate team at Compass with more than ten years of experience helping individuals and families buy and sell real estate in Massachusetts (primarily in the Metro West region).

© 2025 Team Coyle. All rights reserved.

161 Linden, St., Ste 102, Wellesley, MA 01482