Folks It's Official | First Inflation, Now Interest Rate Hikes

Welcome to the New Normal | Higher Interest Rates

If you are thinking about buying a house, then you better act quickly because last week the Federal Reserve (the FED) raised its key policy interest rate (the federal funds rate) by ¼ of a percentage point (see Implementation Note).

And folks that’s not the worst of it. The FED expects to raise interest rates an additional seven more times this year.

Why is the Federal Reserve Raising Rates NOW?

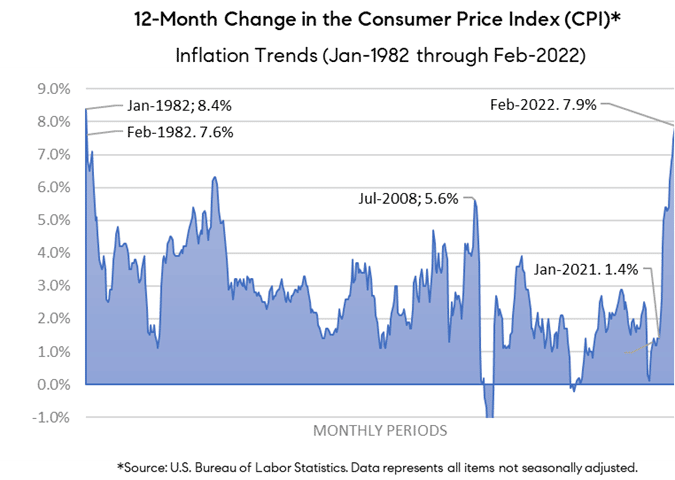

In a word, inflation. In February, the Bureau of Labor Statistics reported that inflation reached a 40-year high of 7.9% (see Chart following). That’s well above the FED’s target rate of 2%. Raising interest rates is one of the major policy tools the FED uses to fight inflation. There’s just one problem. The FED is late to this fight which is why you are going to see successive rate hikes for the remainder of this year as the FED plays catch up. FYI: The next inflation report will be available on April 12, 2022. If you are a betting man or woman, then expect inflation to be even higher. Followed by even higher interest rates.

What is Inflation?

In a nutshell, inflation is a general increase in the price levels of all goods and services in an economy. Thus, the money in your pocket and the savings in your bank account will be worth less than before the effects of inflation. In other words, the purchasing power of the dollar will decline and consumers will be able to afford fewer goods and services.

Some people refer to inflation as a hidden or unlawful tax on their savings since it bypasses traditional lawmaking processes. They are correct. Inflation allows the government to collect more revenue without having to pass a law to raise taxes.

What are the Causes of Inflation?

The answer is relatively simple. Unfortunately, the people who are responsible don’t want to take responsibility and therefore blame everyone else. Those people, politicians of all stripes, want you to believe that inflation comes from greedy businessmen, spendthrift consumers and now Russia. Yet the true culprit is government itself.

According to legendary economist Milton Friedman, “inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

So, who controls the quanity of money in the U.S. economy? The federal government of course. The FED (the central bank of the USA) is responsible for the monetary policies that create or destroy billions of dollars every day. Those policies take into consideration the massive amount of deficit spending (see chart following) that occurs in Congress (both parties) each year.

FEDERAL BUDGET DEFICTS OVER TIME

Source: DataLab

Real Estate | Better Than Owning Gold During Inflationary Periods

Homeowners or investors, the good news is that real estate is an excellent hedge against inflation. Surprisingly, it’s even better than gold as changes in inflation have proven statistically insignificant at explaining changes in gold prices.

Here are THREE reasons why real estate outperforms other asset classes in an inflationary period.

- Ability to Charge Higher Rents (Income): Property owners, in general, benefit from the ability to charge higher annual rents (income) as most leases are indexed for inflation or a 12-month change in the consumer price index (CPI).

- Home Prices Reflect Replacement Cost: Inflation increases construction costs (labor and raw materials) which raises the price (value) of new and existing homes. The latter benefits from the step-up effect associated with higher replacement costs and the previously mentioned ability to charge higher rents.

- Devaluation of Mortgage Debt: Inflation effectively devalues long-term, fixed-rate debt or mortgage loans as it allows borrowers to pay down their fixed-rate debt with inflated (cheaper) dollars.

That’s the good news. The bad news is that inflation typically raises interest rates or borrowing costs which reduces demand for real estate at some point and partially offsets any increase in home prices. Moreover, inflation raises property taxes which partially mitigates the returns received by homeowners and investors.

Bottom line, the pros of investing in real estate outweigh the cons. So if you are a homeowner or investor and you are worried about inflation take solace in the fact that real estate is one of the best investment hedges against inflation.

How Will Inflation Affect Home Values | The Home Buyer’s Perspective?

In short, homebuyers should expect home prices to become more expensive, and the cost of financing to increase as the FED implements its plan to curtail inflation.

As of March 24, 2022, the 30-year fixed rate mortage was 4.42%, that’s 1.31 percentage points higher than it was at 12/30/21. Homebuyers, you should expect that rate to climb even higher as inflation fears grow throughout the year.

Affordability will be the major issue impacting buyer behavior this year. We expect a gradual decline in the pool of eligible buyers as the cost (price and financing) of buying a home increases. We do believe, however, that any decrease in the pool of buyers will be negligible and not meaningfully impact home price growth or contract terms (contingencies) especially in the first half of 2022. In the second half of 2022, we could see home price growth increasing at a decreasing rate and contract terms being reintroduced.

Disclaimer: The views and opinions expressed in this commentary reflect Team Coyle’s beliefs and observations as of the date of publication. Team Coyle undertakes no responsibility to advise you of any changes in the views expressed herein. No representations are made as to the accuracy of such observations and assumptions and there can be no assurances that actual events will not differ materially from those assumed. The forward-looking statements in this paper are based on Team Coyle’s current expectations, estimates, forecasts and projections, and are not guarantees of future performance. Actual results may differ materially from those expressed in these forward-looking statements, and you should not place undue reliance on any such statements. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as investment advice.

Team Coyle

Team Coyle (Matt & Ying) is a top-ranked real estate team at Compass with more than ten years of experience helping individuals and families buy and sell real estate in Massachusetts (primarily in the Metro West region).

© 2025 Team Coyle. All rights reserved.

161 Linden, St., Ste 102, Wellesley, MA 01482