Policymaking Gone Bad | How to Destroy the Housing Market?

State of The Union (U.S.)

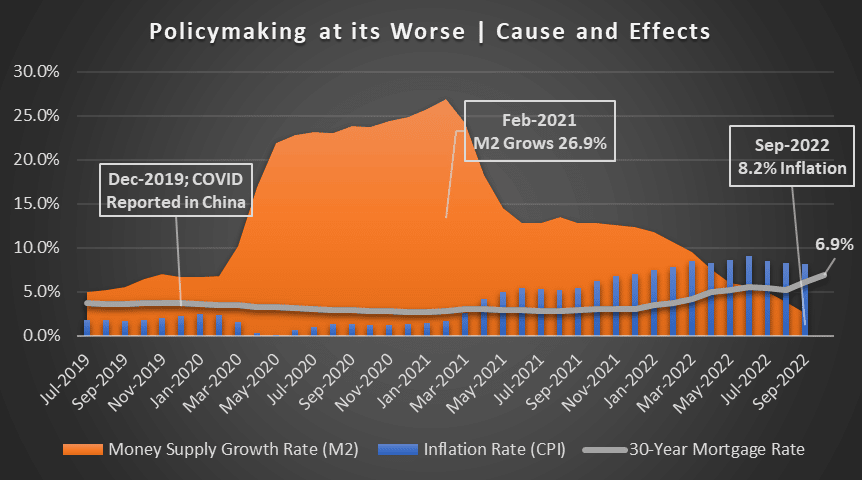

The U.S., courtesy of clumsy government policymaking (fiscal and monetary), is already in the early stages of a recession. This is in part due to the negative effects of inflation which is at a 40-year high. That’s the good news.

The bad news is that economic conditions could get much worse. Today, the Federal Reserve (the FED) – the nation’s central bank – announced it was increasing the federal funds rate by 75 basis points in its effort to fight inflation. Inflation is commonly defined as too much money chasing too few goods.

So, in taking this action, the FED hopes to slowdown and dampen consumer demand for all goods and services which in theory should reduce inflation. At least that’s their plan. Unfortunately, it also will likely reduce GDP growth as consumption is a material driver of U.S. economic activity. Moreover, lower demand for goods and services generally leads businesses to lower production levels which in turn affects employments levels. All totaled, the FED’s actions to curtail inflation will likely lead to worsening economic conditions. The FED, however, is between a rock and a hard place. If the FED does nothing, the risk is that our society will be destroyed by the dangerous and debilitating disease of inflation

How Did We Get Here?

In short, Federal Government policies as enacted by both Congress and the Federal Reserve. Congress is responsible in that it continuously borrows and spends money the U.S Treasury does not have and for items (e.g., Inflation Reduction Act) the American people don’t want or need. Similarly, the Federal Reserve is responsible in that it funds these congressional excesses by loosening monetary policies (money printing, quantitative easing, artificially low interest rates, etc.). Ironically, we are now expecting these same institutions to fix the problem that they created in the first place. Recall what the late and great economist Milton Friedman once said about the causes of inflation:

“There is only one real cure for inflation. It is a cure that's easy to describe but difficult to apply. The gov't must reduce spending and print less money.”

State of Massachusetts Housing Market

The onset of inflation and the subsequent increase in interest rates (mortgage rates in particular) is making it more difficult for the average citizen to afford a home. Indeed, an increasing number of homebuyers can no longer afford the cost of purchasing a home. This development, of course, is placing downward pressure on home prices as home sellers no longer can dictate price and terms to interested buyers. While the housing market has shifted from a “sellers’ market” to a more “balanced market”, the balance has not led to more affordable housing as housing inventories remain low. The cost of inflation and its side effects have eroded the prospective homebuyer’s ability to obtain affordable housing and thus their ability to obtain a piece of the American dream. That’s the cost of poor policymaking. That’s how the Federal Government is destroying the housing market.

About TEAM COYLE

Team Coyle, a professional group of real estate agents at Compass, has more than ten years of experience helping individuals and families buy and sell real estate in the Greater Boston Region of Massachusetts (primarily MetroWest).